AICPA & Beyond: Navigating Health Insurance Options for Accounting Professionals

Hansjan Kamerling

Jan 26

Introduction: Securing Your Most Valuable Asset

Health insurance for accountants is more than just another expense—it's a critical component of financial security and long-term career sustainability. Whether you're a self-employed CPA, work at a small firm without group benefits, or simply need to evaluate your current coverage, understanding your options is essential for protecting both your health and your financial future.

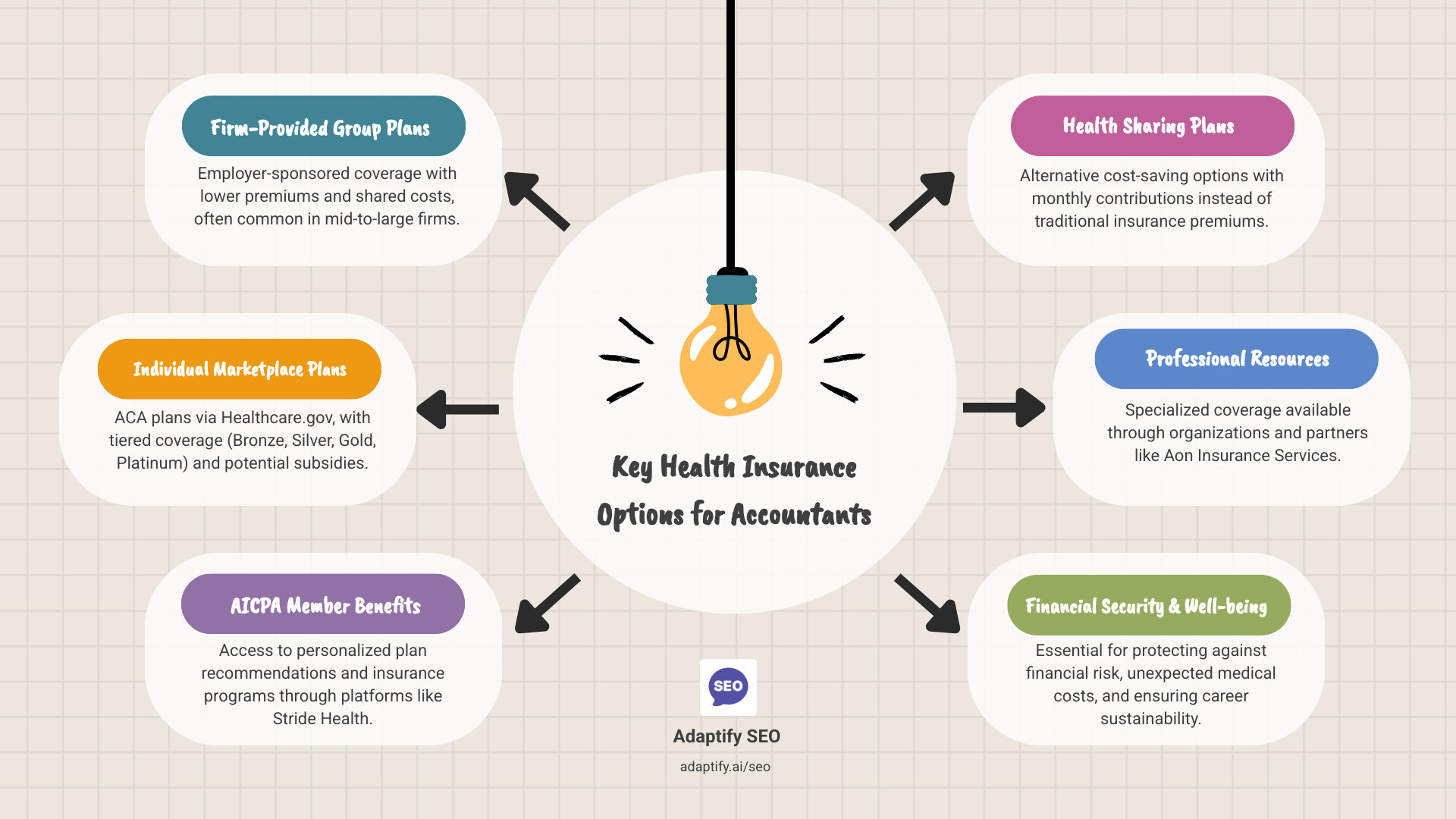

Key Health Insurance Options for Accountants:

- Firm-Provided Group Plans - Employer-sponsored coverage with lower premiums and shared costs

- Individual Marketplace Plans - ACA plans through Healthcare.gov with tiered coverage (Bronze, Silver, Gold, Platinum)

- AICPA Member Benefits - Access to Stride Health platform for personalized plan recommendations

- Health Sharing Plans - Alternative cost-saving option with monthly contributions instead of premiums

- Professional Resources - Specialized coverage through organizations like Aon Insurance Services

The stakes are higher than many accounting professionals realize. According to the Kaiser Family Foundation, average annual health insurance premiums hit $7,911 for single coverage and $22,463 for family coverage as of 2024, before Affordable Care Act subsidies. Meanwhile, deductibles have skyrocketed—from around $1,217 in 2014 to an average of $7,481 for Bronze plans in 2023. For self-employed accountants and those at smaller firms without group benefits, navigating these costs while finding adequate coverage can feel overwhelming.

The accounting profession also faces unique health considerations. With 2,900 workplace injuries reported within the accounting industry in 2018—many related to repetitive strain and poor ergonomics—and the intense stress of tax season, having comprehensive health coverage isn't just about routine care. It's about protecting yourself from both the physical demands of desk work and the mental health challenges that come with managing client finances and meeting tight deadlines.

While our primary expertise is in product design and marketing for SaaS platforms, we've worked extensively with financial services companies and understand the importance of comprehensive planning for accounting professionals seeking health insurance for accountants. Through this guide, we'll help you steer the complex landscape of coverage options so you can make informed decisions that protect both your health and your bottom line.

Why Health Insurance is a Non-Negotiable for Accounting Professionals

As an accounting professional, you spend your days helping clients manage their finances, minimize risk, and plan for the future. But how much attention do you give to your own financial well-being, particularly when it comes to healthcare? Unexpected medical costs can derail even the most carefully crafted financial plans. This is why health insurance for accountants isn't just a good idea; it's an absolute necessity.

The financial risk of being uninsured or underinsured is staggering. A sudden illness, an accident, or even a chronic condition can quickly lead to medical bills that wipe out savings, jeopardize retirement plans, and force difficult financial choices. For self-employed accountants, this risk is amplified, as there's no employer safety net to catch them.

Beyond the financial aspect, accountants face specific health needs. Long hours spent hunched over a desk, meticulous data entry, and the high-pressure environment of tax season can take a toll. Sedentary work can lead to musculoskeletal issues, while the mental strain can contribute to stress, anxiety, and burnout. Comprehensive health coverage provides access to preventative care, specialist consultations, and mental health support, all crucial for maintaining your well-being and, by extension, your career longevity.

The rising cost of health insurance is a stark reality. According to the Kaiser Family Foundation, average annual health insurance premiums hit $7,911 for single coverage and $22,463 for family coverage as of 2024, before Affordable Care Act subsidies are taken into account. These numbers underscore the importance of finding smart, cost-effective solutions.

Having robust health insurance for accountants provides immense peace of mind. It allows you to focus on your work, your clients, and your life, knowing that you're protected against the unforeseen. It's also vital for business continuity; a healthy accountant is a productive accountant.

The Financial Impact of Medical Emergencies

Let's talk numbers, because that's what accountants do best, right? The statistics from the Kaiser Family Foundation are sobering: average annual health insurance premiums hit $7,911 for single coverage and $22,463 for family coverage as of 2024. These are just the premiums! Then there are the deductibles, which have seen a dramatic increase. In 2014, the average deductible for a single person was around $1,217. By 2023, average deductibles had risen to $7,481 for Bronze plans, $4,890 for Silver plans, $1,650 for Gold plans, and $45 for Platinum plans.

Imagine facing a medical emergency with a Bronze plan deductible of nearly $7,500. That's a significant chunk of change, even for a financially savvy accountant. Without adequate coverage, these costs can quickly escalate, forcing you to dip into your emergency fund, take on debt, or even liquidate investments. This directly impacts your ability to protect personal assets and achieve your long-term financial goals, whether that's saving for retirement, buying a home, or funding your children's education. Health insurance acts as a crucial barrier, shielding your hard-earned assets from the unpredictable high costs of healthcare.

Unique Health Considerations for Accountants

While accounting might not be as physically demanding as, say, construction, it comes with its own set of unique health challenges. The sedentary nature of desk work, coupled with repetitive tasks like typing and data entry, makes accountants particularly susceptible to certain conditions.

Consider repetitive strain injuries (RSIs) like carpal tunnel syndrome, which can be debilitating and require extensive treatment, including physical therapy or even surgery. The research shows that in 2018, there were 2,900 workplace injuries within the accounting industry. Many of these are likely related to ergonomics and repetitive motions. Ensuring your health plan covers these types of treatments, including specialists and rehabilitation, is crucial.

Beyond physical ailments, the mental toll of the accounting profession, especially during peak seasons like tax time, can be immense. Long hours, tight deadlines, and the pressure of managing sensitive financial data can lead to stress, anxiety, and burnout. A good health insurance plan should offer robust mental health support, including therapy, counseling, and psychiatric services, to help you manage these pressures and maintain your overall well-being. Preventing burnout isn't just good for you; it's good for your clients and your business too.

Decoding Your Coverage: Key Health Insurance Options

Navigating health insurance can feel like trying to balance a complex ledger – lots of numbers, terms, and regulations to understand! But don't worry, we're here to simplify it for you. The type of health insurance available to you often depends on your employment status. Let's break down the main options.

Firm-Provided Group Health Insurance

For many accountants working in established firms, group health insurance is the most common and often the most advantageous option. These plans are sponsored by your employer and typically offer a range of benefits.

The primary benefits of group plans include generally lower premiums compared to individual plans, because the risk is spread across a larger pool of employees. Employers also often subsidize a significant portion of the premium, further reducing your out-of-pocket costs. Group plans also tend to have broader networks of doctors and specialists and may offer more comprehensive coverage.

When evaluating your employer's options, look beyond just the monthly premium. Consider the deductible, copayments, coinsurance, and the annual out-of-pocket maximum. Also, check the plan's network to ensure your preferred doctors and hospitals are included. These plans are common for mid-to-large size firms and often extend coverage to your spouse and dependents, which is a huge plus for family planning.

Individual & Marketplace Plans: A Guide to Health Insurance for Accountants

If you're a self-employed accountant, work for a small firm that doesn't offer group benefits, or are between jobs, individual health insurance plans are your go-to. The primary avenue for these plans is through the Affordable Care Act (ACA) marketplaces, often referred to as Healthcare.gov or your state's specific marketplace.

The ACA marketplace offers a standardized way to compare plans, which are categorized into "metal tiers":

- Bronze plans: Have the lowest monthly premiums but the highest deductibles and out-of-pocket costs. They cover about 60% of healthcare costs, making them suitable if you're healthy and primarily want protection against catastrophic medical bills.

- Silver plans: Offer moderate monthly premiums and moderate deductibles. They cover about 70% of healthcare costs. This tier is significant because if your income falls within certain limits, you might qualify for "cost-sharing reductions" that lower your out-of-pocket costs even further, making Silver plans a potentially great value.

- Gold plans: Feature high monthly premiums but lower deductibles and out-of-pocket costs. They cover about 80% of healthcare costs, ideal if you anticipate needing frequent medical care.

- Platinum plans: Have the highest monthly premiums but the lowest deductibles and out-of-pocket costs. They cover about 90% of healthcare costs, offering the most comprehensive coverage for those who expect substantial medical needs.

One of the biggest advantages of the ACA marketplace is the availability of subsidies and tax credits. These financial aids can significantly reduce your monthly premiums, making coverage much more affordable, especially for those with moderate incomes. It's important to apply for these subsidies during enrollment to see what you qualify for.

Navigating Enrollment Periods

Understanding when you can enroll in a health insurance plan is just as important as understanding the plans themselves. There are two main periods you need to be aware of:

- Open Enrollment: This is the annual period when you can sign up for a new health plan or change your existing one through the ACA marketplace. For most of the U.S., Open Enrollment begins November 1 and ends on December 15, with coverage typically starting on January 1 of the following year. Miss this window, and you might have to wait until the next year unless you qualify for a Special Enrollment Period.

- Special Enrollment Period (SEP): Life happens, and sometimes you need health coverage outside of the Open Enrollment window. A Special Enrollment Period allows you to enroll in a health plan if you experience a "qualifying life event." These periods typically last for 60 days from the date of the qualifying event.

Here's a list of common Qualifying Life Events:

- Loss of existing health coverage (e.g., losing job-based coverage, COBRA expiring)

- Getting married or divorced

- Having a baby, adopting a child, or placing a child for foster care

- A death in the family that changes your household size

- Moving to a new area with different health plan options

- Changes in household income that affect your eligibility for subsidies

- Becoming a U.S. citizen

- Leaving incarceration

- Changes in your dependent status

If you experience any of these events, make sure to act quickly to take advantage of your SEP. It's your opportunity to get coverage when you need it most.

Specialized Resources and Cost-Saving Alternatives

Finding the right health insurance for accountants isn't just about picking a plan; it's also about leveraging available resources and exploring alternatives that might better suit your unique financial situation.

AICPA Member Benefits and Stride Health

As an accounting professional, you're likely aware of the value of professional organizations. The AICPA (American Institute of Certified Public Accountants) is a prime example, offering a range of resources, including insurance programs. The AICPA Member Insurance Programs, in partnership with Aon, provides members with access to various insurance solutions custom for CPAs.

Specifically for individual health insurance, the AICPA endorses and partners with Stride Health. The Stride Health platform is a fantastic resource for members, their spouses, parents, and friends. It's free to use and designed to simplify the complex process of finding individual health insurance coverage.

Here's what Stride Health offers:

- Plan comparison tool: It aggregates plans from major U.S. insurance companies on both public and private exchanges.

- Personal guidance: Beyond the robust recommendation engine, you have access to personal guidance and educational resources.

- Easy online enrollment: The platform streamlines the enrollment process.

- Cost forecasting: It provides a forecast of the total cost of coverage, including premiums and projected out-of-pocket expenses.

- Dental and vision options: When you visit Stride Health, you can also view plans for dental and vision options, allowing you to get comprehensive coverage.

To get started, we highly recommend visiting the Stride Health platform to find available plan options. It's a powerful tool to help you find the plan that works best for your needs, budget, and personal preferences.

Traditional Insurance vs. Health Sharing Plans

When considering health insurance for accountants, it's important to look at all avenues, including alternatives to traditional insurance. Health sharing plans have gained traction as a potentially cost-effective option, particularly for self-employed individuals and small business owners. But what exactly are they, and how do they compare?

Let's lay out the differences:

| Feature | Traditional Health Insurance | Health Sharing Plans |

|---|---|---|

| Regulation | Regulated by state and federal laws (e.g., ACA, HIPAA) | Not regulated as insurance; exempt from ACA mandates |

| Coverage | Legally bound to pay covered claims; mandated benefits (e.g., maternity, mental health) | Members "share" medical costs based on agreed-upon guidelines; not a legal guarantee of payment |

| Cost | Monthly premiums; often higher, especially without subsidies | Monthly "contributions" or "shares"; often lower than unsubsidized premiums |

| Network | Typically use PPO, HMO, EPO networks with contracted providers | Often no network restrictions, allowing choice of any provider |

| Pre-existing Conditions | Must cover pre-existing conditions after a waiting period (ACA-compliant plans) | May have waiting periods or exclusions for pre-existing conditions |

| Tax Deductibility | Premiums may be tax-deductible for self-employed individuals | Contributions are generally not tax-deductible |

Health sharing plans are typically offered by health sharing ministries, where members with similar ethical or religious beliefs contribute to a common fund to help cover each other's medical expenses. The appeal often lies in the lower monthly contributions.

For example, a self-employed consultant could switch to a health sharing plan costing $350 per month ($4,200 annually) from an unsubsidized health insurance plan that cost $700 per month ($8,400 annually), saving $4,200 each year. Even after factoring in tax deductibility for traditional health insurance premiums (assuming a 22% tax bracket), the net cost for traditional insurance would be around $6,552, while the net cost for the health sharing plan would remain $4,200. This hypothetical example highlights the potential savings.

However, it's crucial to understand that health sharing plans are not traditional insurance. They are not legally bound to pay claims, may not cover all types of care (like preventative services or mental health), and often have limitations or waiting periods for pre-existing conditions. While they can be a viable option for healthy individuals seeking lower costs, we strongly advise thorough research into the specific plan's guidelines, limitations, and the ministry's track record before committing.

Other Essential Coverage for Financial Professionals

While health insurance takes center stage, a comprehensive risk management strategy for accountants extends beyond medical care. As a professional who deals with financial security, you know the importance of protecting all aspects of your livelihood.

- Disability Insurance: What if an illness or injury prevents you from working for an extended period? Disability insurance provides income replacement, ensuring you can still pay your bills and maintain your lifestyle even if you can't generate income. This is especially critical for self-employed accountants. You can Get a Quote for disability insurance through AICPA-endorsed programs.

- Life Insurance: For those with dependents or significant financial obligations, life insurance offers financial protection to your loved ones in the event of your untimely death. It's a cornerstone of responsible financial planning.

- Professional Liability (E&O) Insurance: This is business insurance, distinct from health, but absolutely essential for accountants. It protects you from claims of negligence, errors, or omissions in the professional services you provide. A costly miscalculation, a missed deadline, or incorrect advice could lead to a lawsuit, and E&O insurance helps cover legal defense costs and damages.

Thinking holistically about your insurance needs means building a layered defense against various risks, ensuring your personal and professional finances remain secure.

Managing Costs and Integrating into Your Financial Plan

As an accountant, you're an expert at managing budgets and forecasting financial outcomes. Applying that same rigor to your health insurance decisions is key to finding affordable, effective coverage.

Factors That Influence Your Health Insurance Costs

Several factors play a significant role in determining how much you'll pay for your health insurance for accountants:

- Age: Generally, premiums increase with age, as older individuals tend to have more health needs.

- Location: Healthcare costs and insurance regulations vary by state and even by county, leading to different premium rates.

- Tobacco use: Smokers typically face higher premiums due to increased health risks.

- Plan category: As discussed, Bronze, Silver, Gold, and Platinum plans have different cost structures, balancing premiums with out-of-pocket expenses.

- Number of dependents: Adding a spouse or children to your plan will increase your overall premium.

Understanding these factors allows you to anticipate costs and make more informed choices when comparing plans.

Tax Strategies for Health Insurance for Accountants

One of the smartest ways to manage health insurance costs, especially for self-employed accountants, is to leverage available tax benefits.

- Self-employed health insurance deduction: If you're self-employed and not eligible to participate in an employer-sponsored health plan, you can generally deduct the premiums you pay for health insurance for yourself, your spouse, and your dependents. This is an "above-the-line" deduction, meaning it reduces your adjusted gross income (AGI) and can significantly lower your tax bill.

- Health Savings Accounts (HSAs): HSAs are powerful financial tools available to individuals enrolled in a high-deductible health plan (HDHP). They offer a triple tax advantage:

- Contributions are tax-deductible.

- Earnings grow tax-free.

- Withdrawals for qualified medical expenses are tax-free. HSAs can also act as an investment vehicle. After age 65, you can withdraw funds for any purpose without penalty (though non-medical withdrawals will be taxed as ordinary income), making them a de facto retirement savings account.

- Maximizing tax benefits: By strategically choosing an HDHP with an HSA, or by taking advantage of the self-employed health insurance deduction, you can significantly reduce the net cost of your health coverage. Always consult with a tax professional (perhaps yourself!) to ensure you're maximizing these benefits.

Choosing the Right Plan for Your Budget

The goal is to find a plan that provides adequate coverage without breaking the bank. This often involves a careful balancing act between premiums and deductibles.

- Balancing premiums vs. deductibles: A plan with a lower monthly premium will typically have a higher deductible, meaning you pay more out-of-pocket before insurance kicks in. Conversely, a higher premium usually comes with a lower deductible. Your choice should reflect your anticipated healthcare usage and your comfort level with risk. If you're generally healthy and rarely visit the doctor, a higher-deductible plan (perhaps with an HSA) might save you money. If you have chronic conditions or anticipate frequent medical needs, a higher-premium, lower-deductible plan might be more cost-effective in the long run.

- Out-of-pocket maximums: Always pay attention to the plan's out-of-pocket maximum. This is the most you'll have to pay for covered services in a plan year. Once you hit this limit, your insurance plan pays 100% of your covered healthcare costs. A lower out-of-pocket maximum offers greater financial protection in case of a catastrophic illness or injury.

- Forecasting healthcare needs: Think about your health history, any upcoming medical procedures, prescription needs, and whether you plan to start a family. This forecasting will help you choose a plan that aligns with your expected usage.

- Aligning with your financial plan: Your health insurance choice should integrate seamlessly into your overall financial plan. It's an investment in your well-being and your ability to continue earning and building wealth. Don't view it as merely an expense, but as a critical safeguard for your financial future.

Conclusion: Making the Smartest Investment in Your Health

Navigating the complex world of health insurance for accountants might seem daunting, but as we've outlined, there are numerous options and strategies to ensure you're well-covered. We've explored why health insurance is a non-negotiable for accounting professionals, dug into the specifics of firm-provided, individual, and marketplace plans, and even considered alternatives like health sharing. We've also touched on the critical role of AICPA member benefits and platforms like Stride Health in simplifying your search, and discussed how to integrate health insurance into your broader financial and tax planning.

Your health is truly your most valuable asset, and protecting it with appropriate insurance is one of the smartest investments you can make. Just as you advise your clients to plan for their financial future, we encourage you to be proactive in planning for your own healthcare needs. Don't wait for a medical emergency to highlight the gaps in your coverage.

Take control of your coverage today. Explore the options, compare costs, and choose a plan that safeguards your well-being and aligns with your financial goals. And if you're looking to grow your accounting practice and reach more clients who need your financial expertise, a strong online presence is key.

Explore our SEO services to grow your practice to see how Adaptify SEO can help you connect with more potential clients and build a thriving business.